Assessment Hell

Cess Hell

Mayor Kenney is replacing his main property assessor. Simply will he fix the broken assessment system?

Mar. 06, 2019

With the steady drumbeat of criticism from property owners about the Office of Holding Assessment's 2022 assessments, and Metropolis Council's recent decision not to reapprove OPA's main assessor Michael Piper , the Kenney assistants has announced they'll comport a national search for someone new to pb the city's property assessment office.

But just a 24-hour interval afterwards, in a separate story about OPA's land valuation methods, Kenney spokesman Mike Dunn is even so out there defending the biggest thing OPA is doing wrong.

THIS ARTICLE IS Role OF A CONTENT PARTNERSHIP WITH:

The criticisms of the Office of Property Assessment are coming from a lot of dissimilar directions, and many of those criticisms actually conflict with 1 some other, and then information technology'southward useful to sort out what the complaints are, and what exactly it is that we want the next Chief Assessor to fix.

Regular taxation politics

It'southward important to annotation right up front that a lot of the complaints about OPA are just rooted in apparently old anti-taxation politics. OPA isn't beingness criticized only for things they're doing wrong; they're also getting slammed for things they're doing right.

Property values really have increased by a lot in the neighborhoods ringing Center Urban center and University City, so correctly matching assessed values to market values every few years means people in those neighborhoods are going to keep seeing their taxes become upwardly a lot. That makes people upset, just merely because people are upset doesn't necessarily mean OPA is doing something wrong. Property taxes are going to go on ascent fast in places where values are rising fast, and that's how it should be. Because the alternative is that people in places where real estate values aren't rising as fast, or are even shrinking, will be left paying unfairly high holding tax bills.

Too much deviation

While many of the loudest complaints about over-cess are coming from college-income areas of the urban center, the reality is that many of these areas are notwithstanding under-assessed, and the over-assessed areas are actually in Due north, Southwest, and West Philadelphia, according to a recent analysis past Controller Rebecca Rhynhart.

Information technology's of import to note right up forepart that a lot of the complaints about OPA are just rooted in plain one-time anti-taxation politics. OPA isn't being criticized only for things they're doing wrong; they're also getting slammed for things they're doing right.

Rhynhart's analysis found that 2019'south assessments were some of the well-nigh accurate citywide, only that within specific sub-regions were still way off the mark.

Historically, the OPA has not met the adequate range for uniformity or regressivity since AVI, despite challenge to have met acceptable standards every year since revenue enhancement year 2014. Tax year 2022 is the outset yr in which the OPA accomplished acceptable results for both regressivity and uniformity. For several of the years, the OPA's reported results differed materially from ours, which were determined using industry standard guidelines.

![]()

When yous look at the OPA's accurateness at a geographical basis for tax yr 2019, the OPA is withal outside of acceptable ranges for uniformity and regressivity in 7 of 14 zones, despite its citywide adequate results.

The OPA performs worse in the areas of the city with the lowest median income. These areas of the city have the to the lowest degree uniform and the about regressive assessments. As a result, less expensive homes in Due north, Southwest and Westward Philadelphia tend to be overassessed relative to neighboring more than expensive homes.

An Inquirer analysis from last summer had similar findings, showing that about 35 percent of properties are over-assessed , and these are unduly located in lower-income areas.

Land values are still all over the place

The other big finding in the Controller report is that OPA has gotten worse at assessing state values, starting around 2017. And the event is that they're not fifty-fifty actually trying to value country—which is mostly a function of locational value—and instead are simply taking a flat percent of each property's value and calling that land.

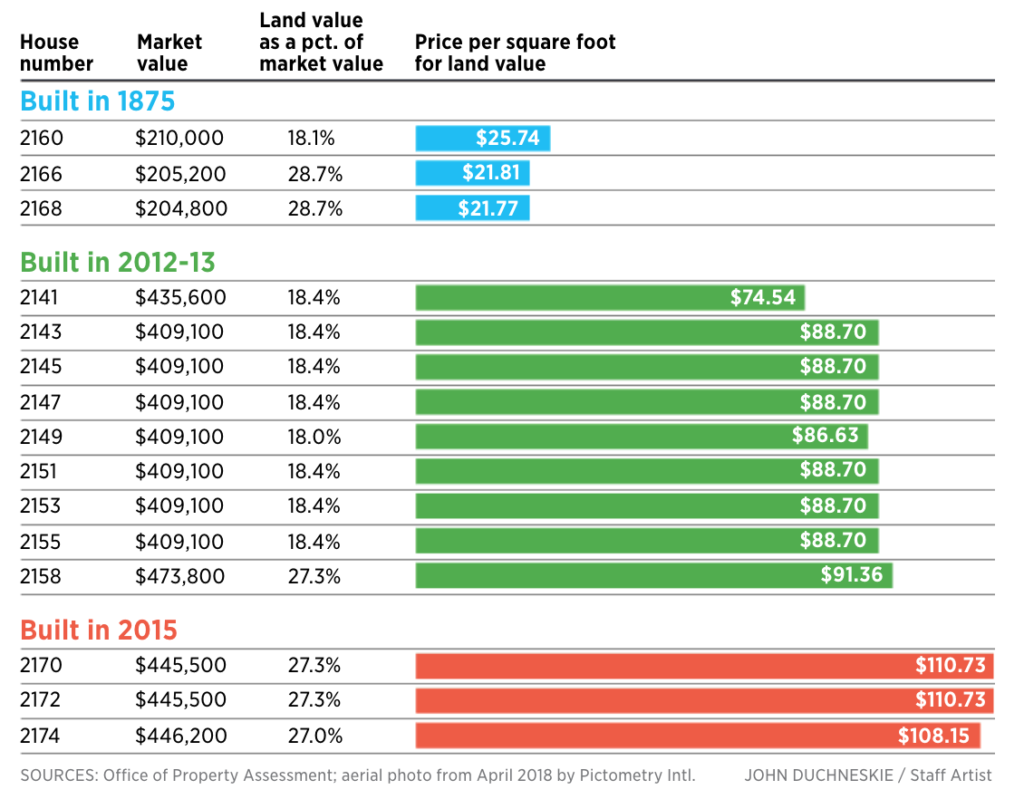

That practice has led to the bizarre outcome where state values leap around a lot inside specific blocks on a square pes basis, where mutual sense would suggest similarly sized lots on the same cake should have nearly identical land values, all else beingness equal. Whatsoever land cess methodology that's turning out vastly different square footage values on the same cake or section of the neighborhood is doing it all incorrect.

The Inquirer looked at one block in Fishtown for an example, where it'due south clear this is what's happening:

Rhynhart constitute that land values for backdrop with 10-year tax abatements were priced higher as a effect of OPA's motion to showtime backing land values out of edifice values in the 2022 assessments. Lots of people thought this was an intentional decision by the Kenney administration to try and collect more holding taxes from people who have abatements, since those property owners nonetheless pay taxes on their land value.

If OPA would finally release their official methodology, as they're required to by constabulary, we'd exist able to get to the bottom of that.

Unfortunately, the Kenney assistants all the same doesn't seem to see annihilation wrong with this approach and they're notwithstanding defending it even as they reluctantly prove Michael Piper the door.

Assessment officials disagreed, calling the 2022 changes "a great comeback," and said OPA is however refining its approach.

The value of remainder country — land that is encumbered by a edifice — is influenced by the value of the structure that sits upon it," Dunn said. "Developing the best structure to the highest permitted density on that land generally maximizes the value of that land.

![]()

The thought that building values feedback into country values isn't wrong, but what is incorrect is the idea that this effect is somehow contained but within that one parcel —rather than diffused throughout the block or neighborhood sub-market place. If a fancy new building makes the land value underneath it go upwardly, it obviously makes the country values of the parcels next door to it go up also, and in the real world y'all'd see it bear on comps inside an even broader geography. The land assessment methodology should accurately reflect this.

What City Council Could Do

Most of the contempo legislative responses coming out of Quango and then far, especially from David Oh and Maria Quinones-Sanchez, are really awful and regressive, and would either leave a lot of tax dollars on the tabular array from people who tin afford to pay ( Oh ) or make a mockery out of the whole concept of fair and accurate assessments ( Sanchez .) Only Council also has played a productive role on this issue in the past, and it's worth highlighting what they've already done well, and how they could build on that.

What if instead of burning down the whole assessment system, the City were to hire someone like Benefits Data Trust to do targeted marketing of the existing successful programs to more eligible belongings owners?

One area where City Council did a legitimately good job during the Nutter administration was designing programs to shield lower-income homeowners and long-fourth dimension residents from big jumps in their belongings tax bills due to corrected assessments. A Philadelphia Fed report found that these programs were very effective at preventing displacement caused by property revenue enhancement pressures, and the main trouble with them is just insufficient awareness and enrollment:

"Philadelphia is unique in its offer of gentrification relief programs, like LOOP, and such programs are quite constructive in terms of reducing long-term homeowner'south revenue enhancement burdens and preventing tax delinquencies," said Ding in an interview. "However, in that location is anecdotal evidence that not all eligible homeowners have enrolled in these programs."

Ding credits the lack of displacement among older and disadvantaged homeowners in gentrifying areas "to the programs that sheltered them from ascension taxes."

"Past raising general awareness of these unique gentrification relief programs and increasing take-upwardly rates, practitioners can help mitigate negative outcomes caused by gentrification," the Fed researcher said.

What if instead of burning down the whole assessment system, the City were to hire someone like Benefits Information Trust to do targeted marketing of the existing successful programs to more than eligible property owners to try and sign everybody up who qualifies?

Some other thing the Mayor and Urban center Council might consider is changing the law to require revenue-neutral assessments, which is something that'due south required in all other Pennsylvania counties except for Philadelphia.

In the rest of Pennsylvania, counties aren't allowed to raise cyberspace revenue during a reassessment. If the real estate tax base grows overall, the county and municipalities and school districts all have to cutting their taxation rates enough to go along their revenue intake the same. Those bodies are still costless to propose a property taxation rate increment during their normal upkeep season if they want to heighten more acquirement from existent manor, just they have to do it transparently by voting on it, rather than sneaking through tax hikes during routine assessments.

This won't brand the anti-revenue enhancement politics go away, just it would reduce some of the sticker shock, and information technology would too get in clearer when the City is voting to raise taxes.

Jon Geeting is the managing director of engagement at Philadelphia iii.0 , a political action committee that supports efforts to reform and modernize City Hall. This is office of a series of articles running in both The Citizen and iii.0's blog.

Photo via Picryl

Source: https://thephiladelphiacitizen.org/assessment-hell/

0 Response to "Assessment Hell"

Post a Comment